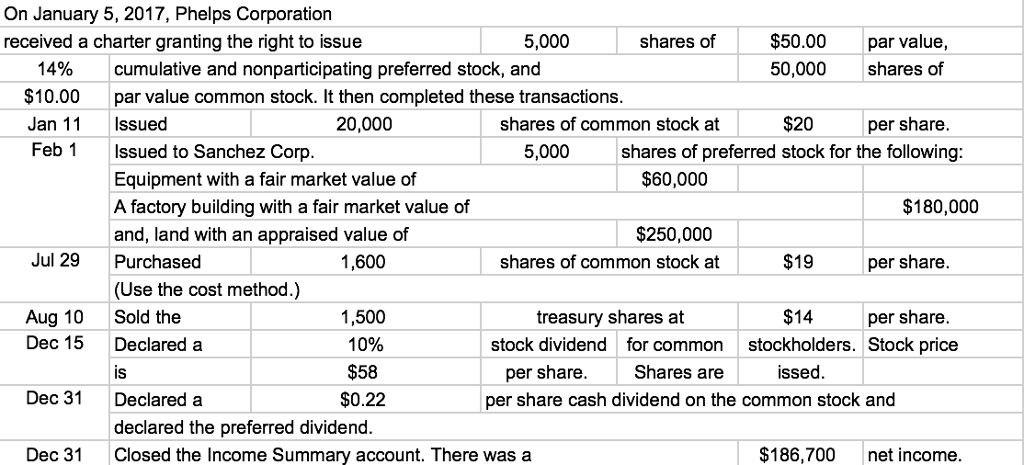

If you are a business owner, it is important to understand how to record common stock issued in your journal entries. The accounting for the issuance of a common stock involves several steps. However, it is crucial to understand that every share has a par value.

- The customary features of common and preferred stock differ, providing some advantages and disadvantages for each.

- After buying back Kevin’s shares, ABC decides to retire the shares on July 31.

- However, states do allow the authorization to be raised if necessary.

- You will hear the words “stock market” and “share market” used interchangeably.

- The legal capital in this example would then be equal to $ 250,000.

- They will be entitled to receive company assets in the event of liquidation after all creditors are settled.

Understanding Goodwill in Balance Sheet – Explained

Some companies may also have other options when raising finance from this source. Usually, this involves preferred stock, which differs from common stock. The common stock that company buyback from the market is recorded as treasury stock in the balance sheet.

What are common shares?

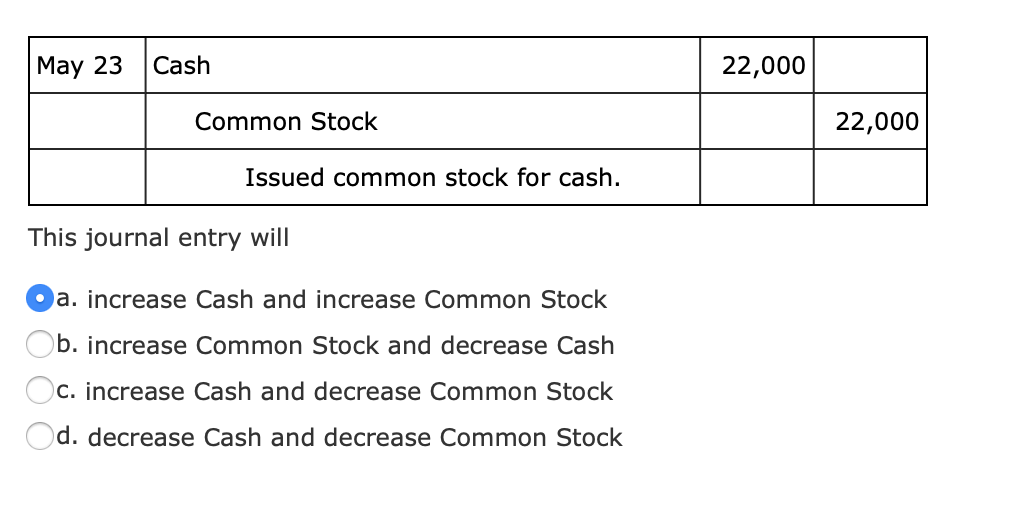

And the $45,000 of the additional paid-in capital comes from the $50,000 amount which is the total market value of shares of common stock given up deducting the $5,000. Recording common stock issued is an important part of managing your business’s finances. The first step in recording common stock issued is to identify the date of issuance and the number of shares issued. Once this has been identified, you can begin recording your journal entry. In the above journal entries, the debit side involves the bank account.

Capitalization of Shareholder Loans to Equity

Rather, they were reported under this heading within stockholders’ equity and subsequently used in computing comprehensive income. The issuance of common stock for a non-cash exchange is less common than for cash, but you will often see this either say in a merger or acquisition or closely held companies. In an acquisition situation, we will often see the exchange of shares for shares. For example, company A will acquire company B, giving company B shareholders a mix of company A shares and cash. Common shares without par value are journalized by debiting cash (asset) for the amount received for the shares and crediting common shares (equity) for the same amount.

The company can make the journal entry for the issuance of common stock for cash at par value by debiting the cash account and crediting the common stock account. Common stock is a financial instrument that represents the ownership of a company. In accounting, this term describes the total finance received from a company’s shareholders over the years.

Shares with a par value of $5 have traded (sold) in the market for more than $600, and many $100 par value preferred stocks have traded for considerably less than par. Par value is not even how does the tax exclusion for employer a reliable indicator of the price at which shares can be issued. New corporations can issue shares at prices well in excess of par value or for less than par value if state laws permit.

Stock split is the process of dividing the current share number into multiple new shares to boost the stock liquidity. The company simply increase the number of outstanding share by a specific time and keep the total dollar value of share the same. Price per share will decrease align with the number of share increases. Retained earnings will be recorded if the additional Paid-in-Capital balance is lower than the difference between cash receive and treasury stock balance.

But small businesses often have more flexible arrangements to raise capital. Management may decide to retire treasury stock in balance sheet. The company will be liable to the shareholders in case of the market price fall below par value. There are no application or allotment accounts we have to deal with.

As mentioned, the share capital account will only include the par value of the shares. The excess amount of $50,000 ($150,000 – $100,000) ended up on the share premium account. The debit side will include the full amount of the finance received. Hence, we may come across the circumstance in which the common stock has no par value (e.i., no par value registered on the stock certificate). In this case, when we issue the common stock, we will need to record the entire amount of cash received to the common stock account without additional paid-in capital involved. In this journal entry, the total expenses on the income statement and the total equity on the balance sheet increase by the same amount.