Here are some frequently asked questions (FAQs) and answers that address key concepts related to manufacturing costs. With a breakup of all the costs of manufacturing, management can decide whether it is more profitable to purchase certain parts or materials from a vendor or manufacture them in-house. As you can see, by collecting cost data and calculating it accurately, businesses can optimize cost management and set the right price for their products to gain a competitive advantage. Here’s an interesting case study on how manufacturing cost analysis helped a steel manufacturing company save costs.

1. Direct materials as a type of manufacturing costs

Unlike relevant costs, they do not have an impact on the matter at hand. Relevant cost – cost that will differ under alternative courses of action. In other words, these costs refer to those that will affect a decision. A word used by accountants to communicate that an expense has occurred and needs to be recognized on the income statement even though no payment was made. The second part of the necessary entry will be a credit to a liability account.

Keep Your Business Afloat With These Budgeting Methods

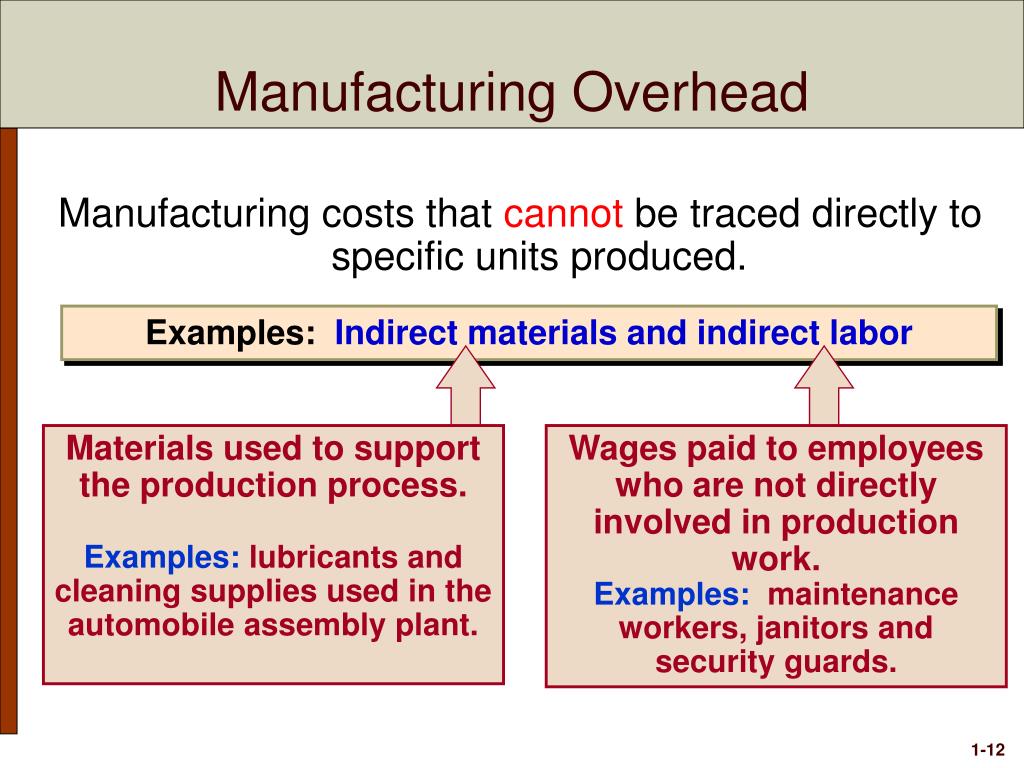

We use the term nonmanufacturing overhead costs or nonmanufacturing costs to mean the Selling, General & Administrative (SG&A) expenses and Interest Expense. Under generally accepted accounting principles (GAAP), these expenses are not product costs. (Product costs only include direct material, direct labor, rstars data entry guide ch #4 and manufacturing overhead.) Nonmanufacturing costs are reported on a company’s income statement as expenses in the accounting period in which they are incurred. Distinguishing between the two categories is critical because the category determines where a cost will appear in the financial statements.

Step #4: Calculate the indirect costs (manufacturing overheads)

However, as we noted earlier, managerial accounting information is tailored to meet the needs of the users and need not follow U.S. They form part of inventory and are charged against revenue, i.e. cost of sales, only when sold. All manufacturing costs (direct materials, direct labor, and factory overhead) are product costs. Nonmanufacturing overhead costs are the business expenses that are outside of a company’s manufacturing operations. In other words, these costs are not part of a manufacturer’s product cost or its production costs (which are direct materials, direct labor, and manufacturing overhead).

For example, a clothing manufacturer considers employees that dye the cloth, cut the cloth and sew the cloth into a garment as direct labor costs. However, designers and sales personnel are considered nonmanufacturing labor costs. These costs are not directly tied to the production of goods or services, but rather to the overall operation of the company. Examples of period costs may include rent, salaries and wages of administrative staff, office supplies, marketing and advertising expenses, and other similar expenses. While these costs are necessary for the overall functioning of the business, they do not directly contribute to the production of goods or services. Manufacturing costs refer to those that are spent to transform materials into finished goods.

The Difference Between Manufacturing and Nonmanufacturing Costs

- After manufacturing product X, let’s say the company’s ending inventory (inventory left over) is $500.

- Incorporating climate costs shows that the real cost of manufacturing these materials is much higher than current market prices.

- Examples of direct materials for each boat include the hull, engine, transmission, carpet, gauges, seats, windshield, and swim platform.

- Calculating manufacturing costs helps assess whether producing the product is going to be profitable for the company given the existing pricing strategy.

- Other manufacturing overhead items are factory building rent, maintenance and depreciation for production equipment, factory utilities, and quality control testing.

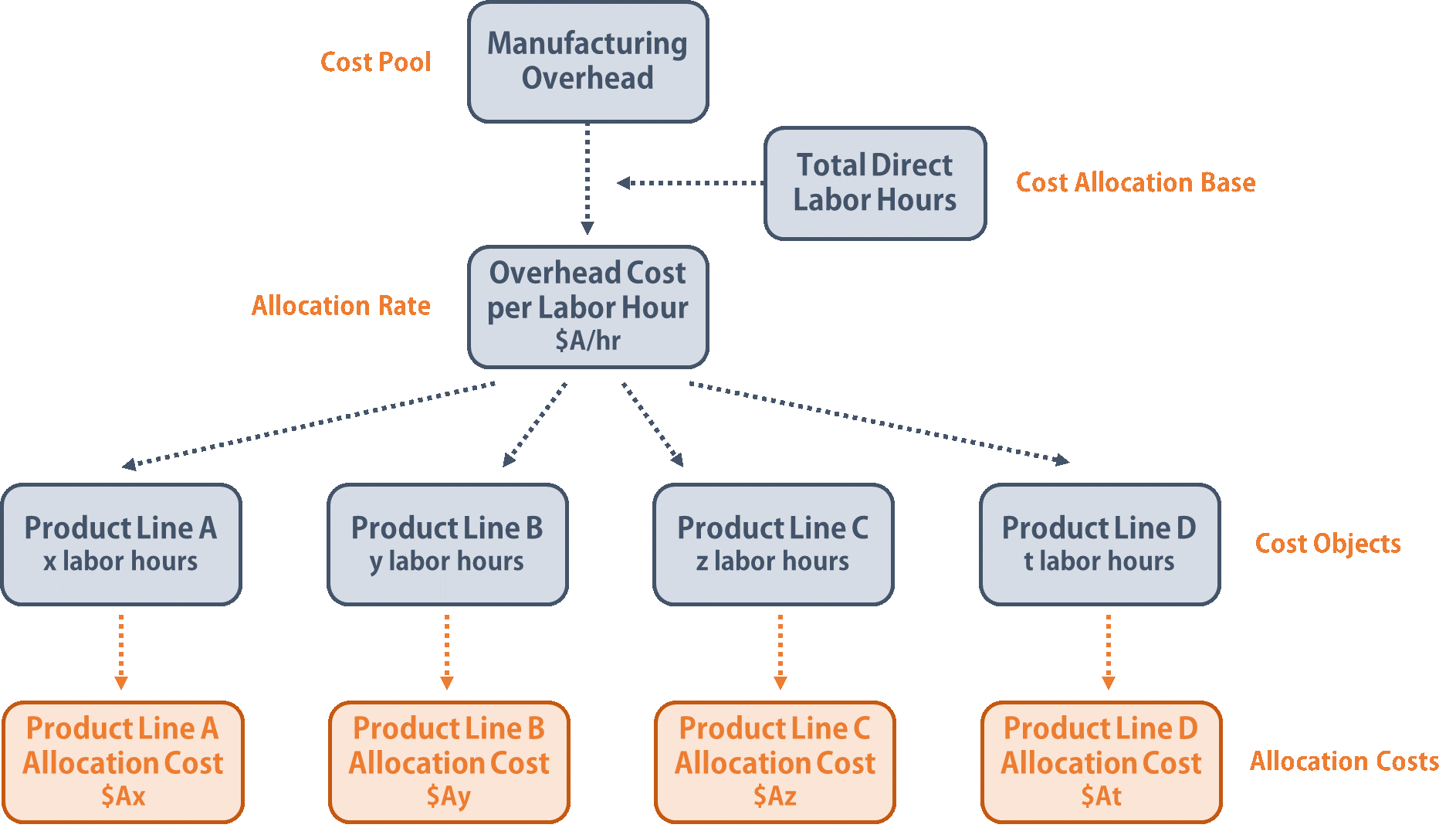

All other manufacturing costs are classified as manufacturing overhead. All nonmanufacturing costs are not related to production and are classified as either selling costs or general and administrative costs. Manufacturing overhead are costs that are not part of labor or material cost and can be either a fixed or variable cost. For instance, fixed overhead costs consist of property taxes, insurance premiums, depreciation and nonmanufacturing employee salaries, according to Accounting Tools. Whereas, variable direct manufacturing overhead costs include indirect labor, indirect material and utilities. Though most of these costs are self-evident, indirect material costs are unique because these costs are not essential to the physical production of the product.

This is important because while climate costs of energy can be reduced by switching to renewable sources, process costs are fixed unless we can develop new processes or substitute materials. For example, manufacturing aluminum generates quite a lot of carbon dioxide per weight of product, while making the same amount of brick generates much less. But the tonnage of bricks produced every year is far higher than that of aluminum, so making bricks contributes more to climate costs overall than making aluminum. Table 2.3.1 provides several examples of manufacturing costs at Custom Furniture Company by category.

PepsiCo, Inc., produces more than 500 products under several different brand names, including Frito-Lay, Pepsi-Cola, Gatorade, Tropicana, and Quaker. Net sales for 2010 totaled $57,800,000,000, resulting in operating profits of $6,300,000,000. Cost of sales represented the highest cost on the income statement at $26,600,000,000. The second highest cost on the income statement—selling and general and administrative expenses—totaled $22,800,000,000. These expenses are period costs, meaning they must be expensed in the period in which they are incurred.

Manufacturing costs include direct materials, direct labor, and factory overhead. Costs that are not related to the production of goods are called nonmanufacturing costs; they are also referred to as period costs. These costs have two components—selling costs and general and administrative costs—which are described next. Costs that are not related to the production of goods are called nonmanufacturing costs23; they are also referred to as period costs24. Non-manufacturing costs refer to expenses that are not directly tied to the production of goods or services. These costs encompass a variety of expenses such as selling, administrative, and research and development costs, which support the overall operations of a business but do not contribute to the creation of products.

These informed decisions help in maximizing productivity and profitability. Let’s go through all the steps for calculating total manufacturing costs. Now that you are familiar with the components that constitute manufacturing costs, let’s move on to the process of calculating these expenses.